25 Reasons to Avoid Lquid Pay Credit Cards

1. Fraudulent Leadership

SHAVEZ ANWAR, the mastermind behind Lquid Pay, has a history of involvement in scams like StableDAO and We Are All Satoshi. Trusting your financial information with such an individual is a recipe for disaster.

2. Fake Visa Partnerships

Lquid Pay falsely claims to have partnerships with Visa and other major payment processors. Visa has publicly denied any relationship with this company.

3. Unproven Technology

The technology behind these cards is unverified and likely non-existent. Your funds could vanish without a trace.

4. Dangerous Wallet Connections

Connecting your crypto wallet to a scammer’s card system gives them unrestricted access to your funds. They can drain your wallet at any time.

5. Untraceable Losses

Blockchain transactions are irreversible. If funds are stolen from your crypto wallet, there’s no way to recover them.

6. Non-Functional Cards

Users report that the cards do not work as promised. Many have received non-functional cards or none at all.

7. False Advertising

Lquid Pay markets cashback and rewards programs that sound too good to be true—and they are. No one has received the advertised rewards.

8. Lack of Customer Support

Once your funds are gone, Lquid Pay is unreachable. Complaints are ignored, and no refunds are issued.

9. Rebranding to Escape Scrutiny

The switch from 9Pay to Lquid Pay shows a clear attempt to dodge accountability after being exposed by investigative journalists.

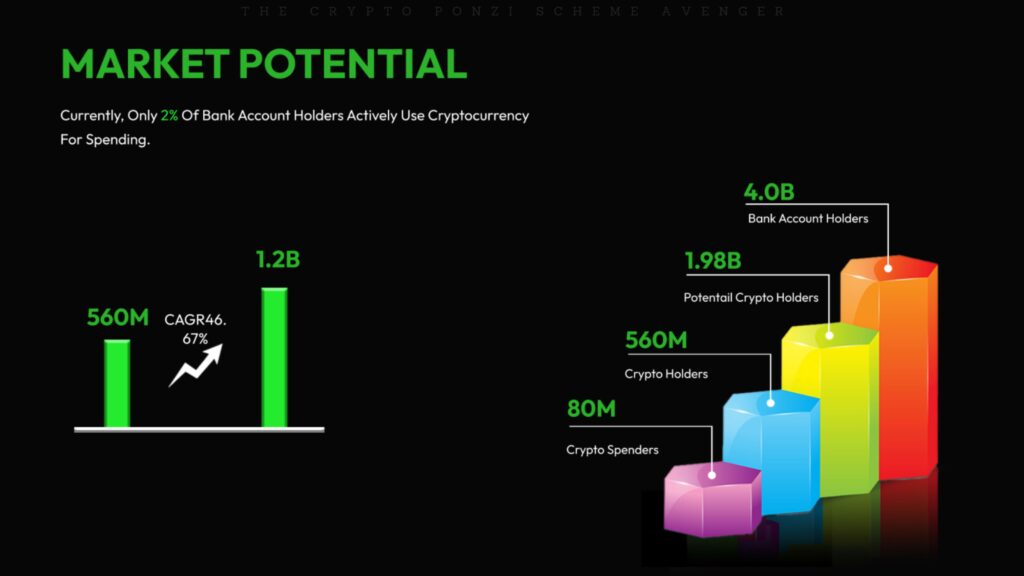

10. Questionable Staking Programs

Their staking schemes are classic Ponzi setups. Early participants are paid with funds from new victims.

11. Unsecured Data Handling

Your personal and financial data is at risk. There’s no guarantee that Lquid Pay uses proper encryption to protect your sensitive information.

12. No Regulatory Oversight

Despite claiming compliance, Lquid Pay operates outside any legal regulatory frameworks, leaving you unprotected.

13. Fabricated Testimonials

The glowing reviews on their website are written by bots or fabricated personas.

14. Non-Existent Customer Base

Despite claiming global merchant acceptance, no verified businesses accept Lquid Pay cards.

15. High Transaction Fees

Hidden fees make transactions far more expensive than traditional credit cards or legitimate crypto solutions.

16. Dubious Pre-Sales

Investors are lured into pre-sales with promises of exclusivity, only to be left empty-handed.

17. Zero Transparency

There’s no clear explanation of how Lquid Pay processes transactions or manages funds.

18. No Legal Protections

Unlike traditional credit cards, Lquid Pay offers no fraud protection or chargeback mechanisms.

19. Scam Endorsements

Shavez Anwar uses deceptive tactics, like falsely claiming partnerships with regulatory bodies, to appear legitimate.

20. Unstable System

Reports indicate frequent glitches and downtime, making the card unreliable for any real-world use.

21. Inconsistent Branding

Frequent name changes (e.g., 9Pay to Lquid Pay) indicate an attempt to escape negative press and past failures.

22. Non-Existent Insurance

The company claims to protect against unauthorized transactions but offers no evidence or valid insurance policy.

23. Lack of Real-World Use

Despite grand claims, there’s no proof that Lquid Pay works for everyday transactions at major retailers or platforms.

24. Global Merchant Lies

They advertise acceptance by over 100 million merchants globally, which is completely unfounded.

25. A Track Record of Failure

Shavez Anwar and his team have been involved in numerous failed crypto schemes, leaving investors with nothing but losses.

Final Warning

Investing in a Lquid Pay credit card is not just a financial risk—it’s an open invitation for scammers to access your funds and sensitive information. Protect yourself and others by staying away from this dangerous scheme.